Rahasia Keuntungan Maksimum dengan Login Slot Gacor Maxwin

Slot Gacor Maxwin adalah salah satu jenis permainan slot yang saat ini sedang populer di kalangan penggemar judi online. Apa itu Slot Gacor Maxwin? Slot Gacor Maxwin adalah istilah yang digunakan untuk menggambarkan mesin slot yang memberikan keuntungan maksimum kepada para pemainnya. Dibandingkan dengan jenis slot lainnya, Slot Gacor Maxwin memiliki tingkat keberhasilan yang tinggi, sehingga banyak pemain yang tertarik untuk mencobanya.

Bagaimana cara bermain Slot Gacor Maxwin? Untuk bermain Slot Gacor Maxwin, Anda perlu mendaftar terlebih dahulu di situs Slot Gacor Maxwin yang terpercaya. Setelah mendaftar, Anda akan diberikan akun untuk masuk dan bermain. Selanjutnya, Anda tinggal memilih mesin slot yang ingin Anda mainkan. Pastikan untuk memahami aturan dan cara bermain dari setiap mesin slot, karena setiap mesin memiliki fitur dan pola pembayaran yang berbeda. Slot Gacor Hari Ini

Bagaimana cara menang di Slot Gacor Maxwin? Ada beberapa strategi yang dapat Anda gunakan untuk meningkatkan peluang menang di Slot Gacor Maxwin. Salah satunya adalah dengan mempelajari pola pembayaran dari setiap mesin slot. Beberapa mesin lebih cenderung memberikan kemenangan yang lebih tinggi pada saat-saat tertentu, seperti ketika jackpot belum lama ini dibagikan. Anda juga dapat memanfaatkan fitur-fitur bonus yang ada pada mesin slot, seperti putaran gratis atau bonus multiplier.

Untuk dapat bermain di Slot Gacor Maxwin, Anda perlu mendaftar di situs Slot Gacor Maxwin yang terpercaya. Proses pendaftarannya cukup sederhana dan biasanya hanya membutuhkan beberapa langkah. Anda akan diminta untuk mengisi formulir pendaftaran dengan data pribadi yang valid. Setelah itu, Anda akan mendapatkan akun untuk masuk ke situs dan bermain Slot Gacor Maxwin. Pastikan untuk memilih situs yang telah terbukti aman dan terpercaya agar dapat bermain dengan nyaman dan mendapatkan pengalaman bermain yang maksimal.

Apa Itu Slot Gacor Maxwin

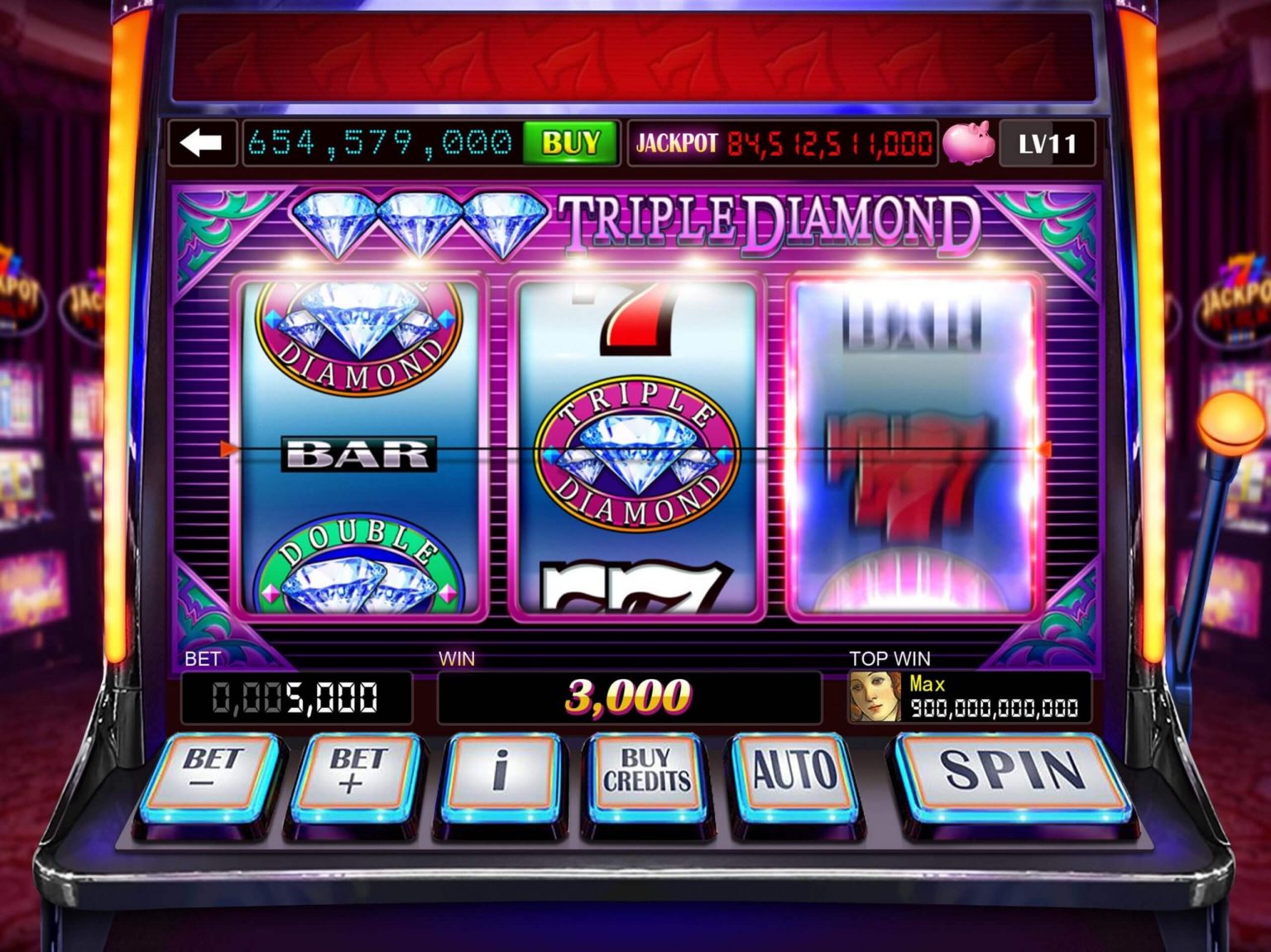

Slot Gacor Maxwin adalah salah satu jenis permainan slot online yang sangat populer di kalangan pemain judi. Permainan ini menawarkan keseruan dan peluang keuntungan yang tinggi bagi para pemainnya. Slot Gacor Maxwin didesain dengan grafis yang menarik dan fitur-fitur menarik yang membuat pengalaman bermain menjadi lebih menyenangkan.

Dalam permainan Slot Gacor Maxwin, pemain dapat memutar gulungan dengan tujuan untuk mendapatkan kombinasi simbol yang tepat. Setiap simbol memiliki nilai yang berbeda-beda, dan pemain akan mendapatkan kemenangan jika berhasil menghasilkan kombinasi simbol yang sesuai dengan aturan permainan. Selain itu, terdapat juga fitur bonus yang dapat memperbesar peluang pemain untuk memenangkan hadiah yang lebih besar.

Untuk dapat bermain Slot Gacor Maxwin, pemain perlu mendaftar akun di situs yang menyediakan permainan ini. Proses pendaftaran di situs Slot Gacor Maxwin biasanya mudah dan cepat. Setelah mendaftar, pemain dapat melakukan login ke akunnya dan mulai bermain permainan Slot Gacor Maxwin dengan memilih mesin slot yang diinginkan.

Jadi, untuk para pemain judi online yang mencari keseruan dan peluang keuntungan maksimum, Slot Gacor Maxwin dapat menjadi pilihan yang tepat. Dengan fitur-fitur menarik dan kesempatan yang tinggi untuk memenangkan hadiah besar, permainan ini menawarkan pengalaman bermain yang mengasyikkan dan menguntungkan.

Cara Bermain Slot Gacor Maxwin

Untuk memulai permainan Slot Gacor Maxwin, Anda perlu terlebih dahulu mendaftar di situs Slot Gacor Maxwin yang terpercaya. Setelah berhasil mendaftar, Anda akan mendapatkan akun yang dapat digunakan untuk login ke dalam situs tersebut.

Setelah masuk ke dalam situs, pilihlah permainan Slot Gacor Maxwin yang ingin Anda mainkan. Di dalam permainan, Anda akan melihat gulungan atau reel yang berisi simbol-simbol. Tugas Anda adalah mencoba mencocokkan simbol-simbol tersebut dalam urutan yang diperlukan.

Untuk memainkan permainan Slot Gacor Maxwin, Anda tinggal mengklik tombol ‘Putar’ atau ‘Spin’. Gulungan akan berputar dan berhenti secara acak, menampilkan rangkaian simbol baru pada setiap putaran. Jika Anda berhasil mencocokkan simbol-simbol tertentu sesuai dengan ketentuan yang berlaku, Anda akan memenangkan hadiah sesuai dengan kombinasi yang terbentuk.

Itulah cara bermain Slot Gacor Maxwin yang sederhana dan mudah dipahami. Selamat mencoba peruntungan Anda di dunia Slot Gacor Maxwin!

Cara Menang Slot Gacor Maxwin

Mendapatkan kemenangan saat bermain Slot Gacor Maxwin dapat menjadi pengalaman yang mengasyikkan. Berikut ini adalah beberapa tips dan trik yang dapat membantu Anda untuk memenangkan permainan Slot Gacor Maxwin:

-

Pilihlah mesin slot yang tepat: Sebelum memulai permainan, penting untuk memilih mesin slot yang sesuai dengan preferensi dan tingkat keterampilan Anda. Perhatikan faktor-faktor seperti RTP (Return to Player), variasi, dan fitur bonus yang ditawarkan oleh mesin. Dengan memilih mesin yang sesuai, Anda dapat meningkatkan peluang Anda untuk memenangkan hadiah yang besar.

-

Kelola keuangan dengan bijak: Sebelum memulai permainan, tetapkan batas keuangan yang dapat Anda pertaruhkan. Selalu ingat untuk bermain dengan uang yang Anda siap kehilangan, dan jangan pernah melebihi batas yang telah ditetapkan. Mengelola keuangan dengan bijak akan membantu Anda menghindari kerugian yang besar dan mempertahankan keseimbangan permainan yang sehat.

-

Manfaatkan strategi taruhan yang tepat: Dalam permainan Slot Gacor Maxwin, penting untuk memiliki strategi taruhan yang efektif. Pertimbangkan untuk menggunakan strategi taruhan seperti Martingale atau Paroli untuk meningkatkan peluang menang Anda. Selain itu, bijaksanalah dalam menentukan jumlah taruhan Anda. Mengubah ukuran taruhan Anda secara strategis dapat membantu meningkatkan peluang Anda untuk memenangkan hadiah yang lebih besar.

Dengan mengikuti tips dan trik di atas, Anda dapat meningkatkan peluang Anda untuk memenangkan permainan Slot Gacor Maxwin. Ingatlah untuk tetap bersenang-senang dan bermain dengan bijak. Semoga berhasil!